personal property tax rate richmond va

The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered.

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments.

. Welcome to the official Richmond County VA Local Government Website. At a Special Meeting this week City Council unanimously approved the extension of the 2022 due date for both personal property taxes and machinery tools taxes. Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours.

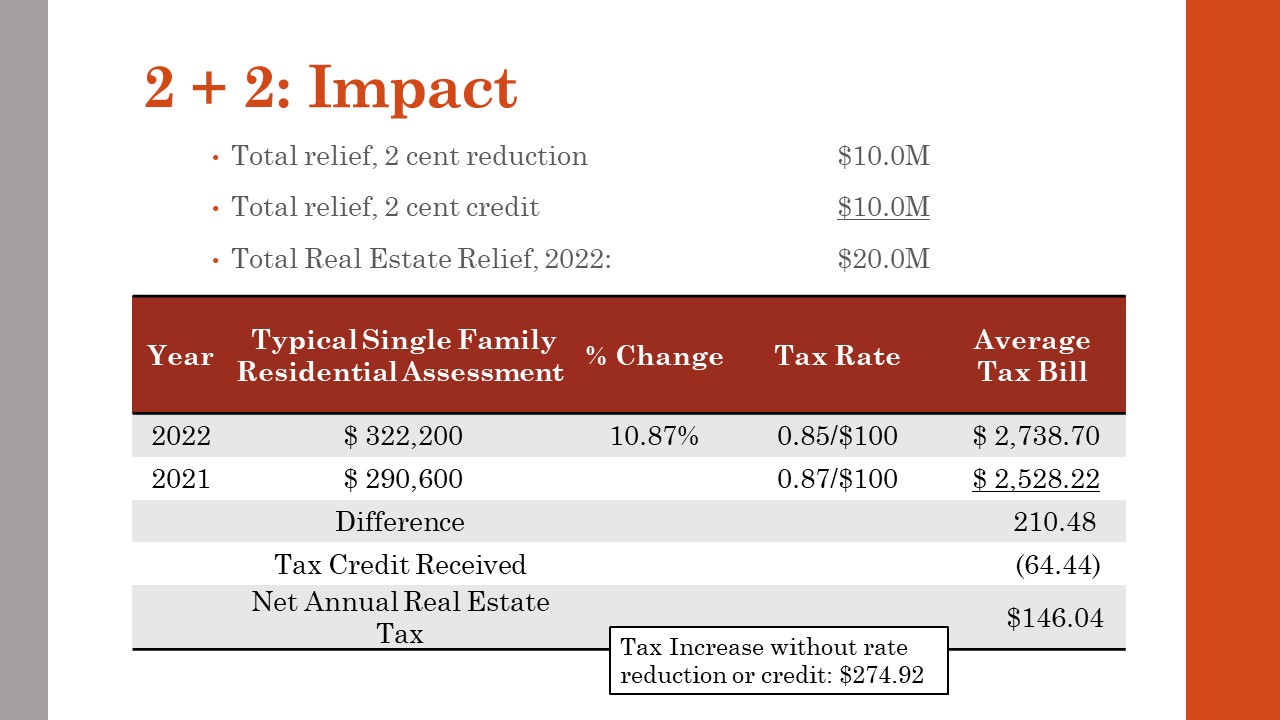

There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues. It is estimated that by freezing the rate the city will provide Richmonders more than 8. Personal Property Tax Relief.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. 1 day agoA city resident with property assessed at 400000 would have an annual tax bill of 4800 under the citys current tax rate. Under Virginia law the government of Richmond.

We have done our best to provide links to information regarding the County and the many services it provides to its. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. The county also can.

Counties in Virginia collect an average of 074 of a propertys assesed fair. Tax rates differ depending on where. Richmond City collects on average 105 of a propertys assessed.

With the 13 jump the property owner would pay 624. Welcome to the official site of the Virginia Department of Motor Vehicles with quick access to driver and vehicle online transactions and information.

Calls Mount For City S Property Tax Decision Richmond Free Press Serving The African American Community In Richmond Va

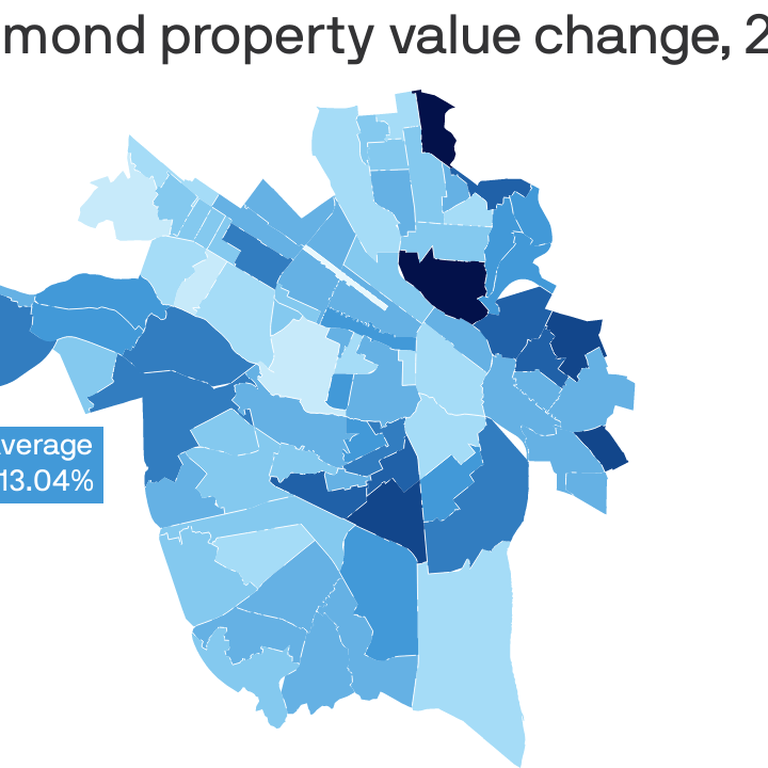

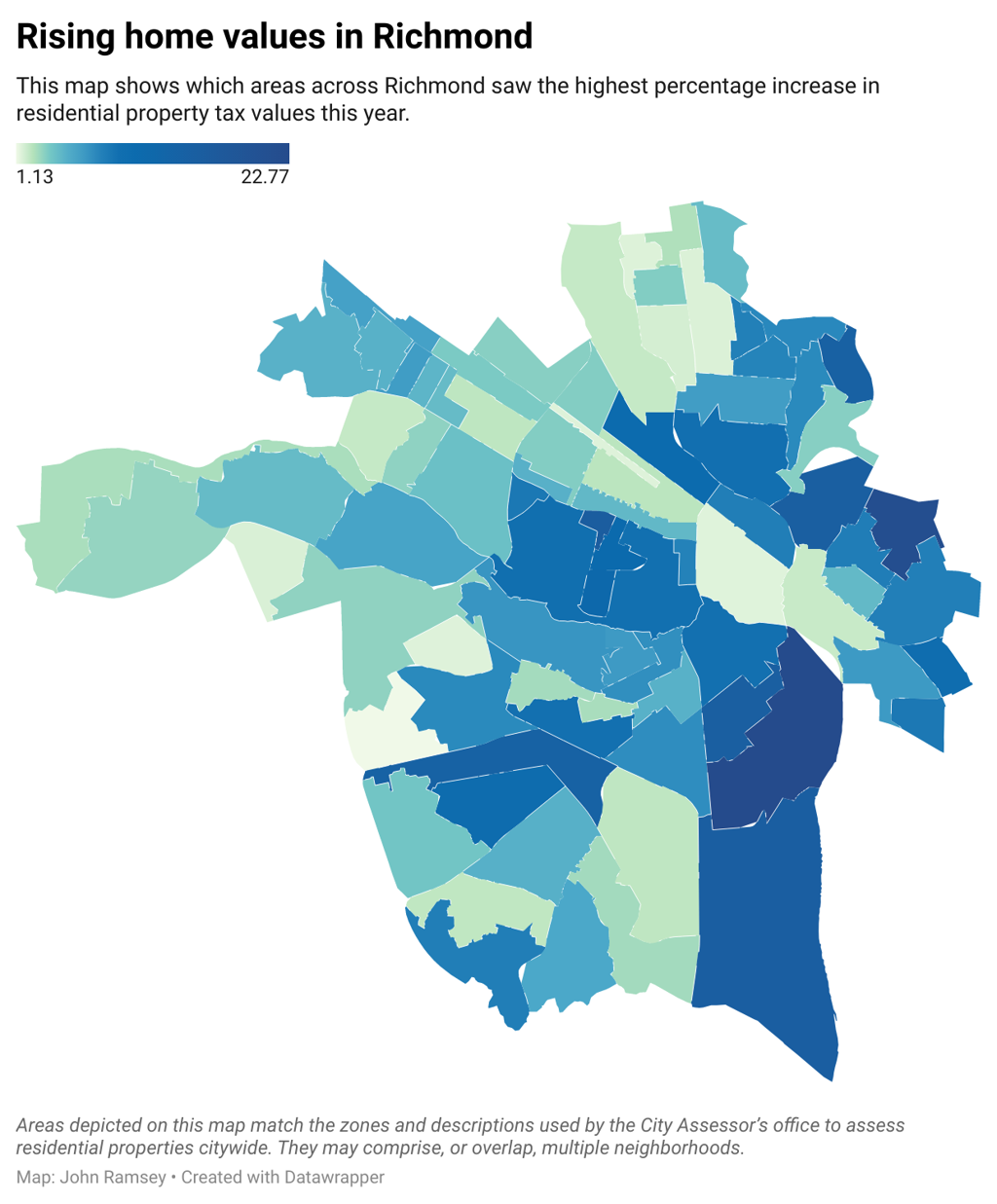

Where Richmond Property Values Went Up Most Axios Richmond

Many Left Frustrated As Personal Property Tax Bills Increase

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

News Flash Chesterfield County Va Civicengage

Home Greater Richmond Partnership Virginia Usa

Property Tax Calculator Smartasset

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Sales Taxes In The United States Wikipedia

For State Tax Purposes Is It Better To Live In Virginia Maryland Or Dc Quora

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Chesterfield Considers 41 Million Tax Break For Waterpark Housing Wric Abc 8news

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Proposals To Cut Richmond S Real Estate Tax Rate Move Forward Without Recommendations Wric Abc 8news

Richmond City Council Virginia Usa Richmond Va

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com